The Day AI Eroded $23 Billion from Logistics: What Wall Street Misses

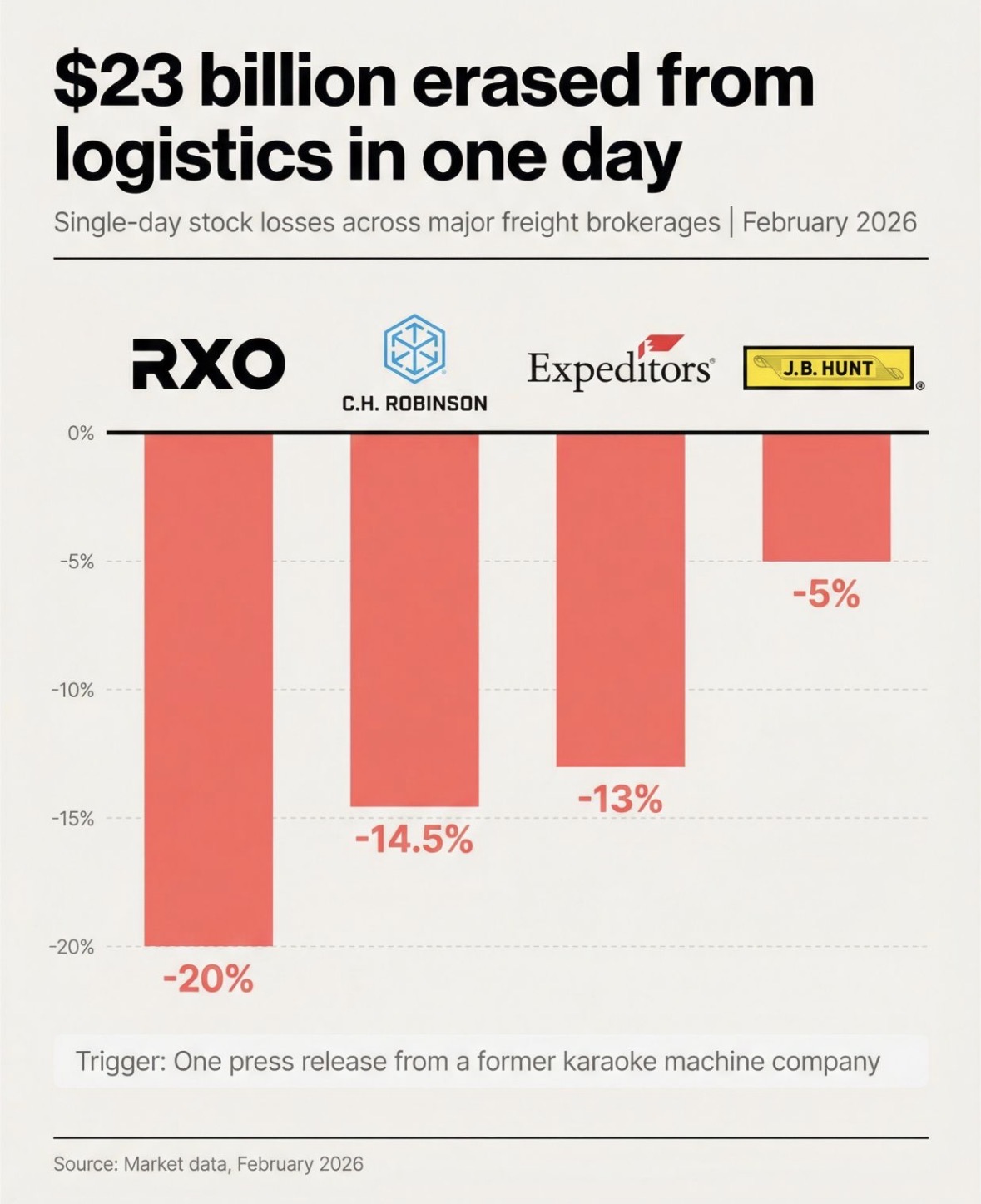

The logistics world just got a wake-up call. In one day, an AI tool managed to erase $23 billion from the sector. RXO plunged by 20%, CH Robinson by 14.5%, Expeditors by 13%, and JB Hunt by 5%. The catalyst? Algorhythm Holdings, a former karaoke machine seller, pivoted to AI freight with their SemiCab platform. Wall Street is finally pricing in what fleet operators have known for years: the middlemen are getting automated. But here's what they're missing.

The Karaoke Machine Pivot

Algorhythm Holdings was in the business of selling karaoke machines until last year. They sold that division for $4.5 million and pivoted to AI freight. Their SemiCab platform promises to scale freight volume by 300-400% without adding headcount and claims a 70% reduction in empty miles. On the surface, these are staggering figures. The market responded by catapulting the stock, which was a penny stock on Wednesday, up by 30% on Thursday.

The Empty Mile Myth

Here's the problem: the claim of a 70% reduction in empty miles is fundamentally flawed. Empty miles aren't just a software problem; they're a network density problem. To eliminate empty miles, you need freight to fill the lanes. No algorithm can create a backhaul where none exists. The logistics network is about real-world connections, not just software solutions.

Wall Street's Wake-Up Call

The market reaction isn't entirely wrong—it's just premature. Freight brokerages thrive on information asymmetry. They leverage their knowledge of rates and capacity, which shippers and carriers lack. AI poses a significant threat to this model. Not from a single press release, but from an army of tools gradually closing the information gap over the next 3-5 years.

The brokerages that will survive are those investing in proprietary networks and technology. The ones relying solely on "relationships" as their competitive edge are on borrowed time. Fleet operators, on the other hand, were reminded that their tangible assets aren't disrupted by a mere press release.

The Future: Broker-Optional Freight

The future of freight isn't broker-free; it's broker-optional. This shift represents a fundamentally different business model. Brokerages must adapt to survive in a world where AI tools chip away at their traditional strongholds. Information symmetry is the new battleground, and those who embrace technology and innovation will lead the charge.

The MorPro Vision

At MorPro, we've been preparing for this transformation. Yamil Morales, our CEO, predicted this shift years ago. We're building the operating system for modern trucking—a comprehensive logistics ecosystem that integrates technology, real trucking operations, and automation. MorPro's suite of services and platforms, including MorPro OS, NextMS TMS, GoSpotty, and Brokerless, positions us at the forefront of this industry evolution.

The Bottom Line

The logistics industry is at a crossroads. AI and technology are reshaping the landscape, and those who fail to adapt will be left behind. For fleet operators, the message is clear: your assets are secure, but innovation will drive growth. For brokerages, it's time to invest in technology and rethink your business model.

At MorPro, we're ready to lead this transformation. We're building the future of logistics—one that leverages technology to create efficiencies, reduce costs, and improve service delivery. Visit morpro.io to learn more about how we're shaping the future of trucking, or get in touch to see how we can help your business thrive in this new era.